May 2014 Housing Starts in Toronto

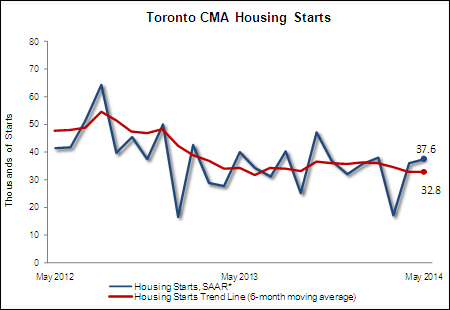

Author: Toronto Real Estate Admin / Category: News BulletinTORONTO, June 9, 2014 — Housing starts in the Toronto Census Metropolitan Area (CMA) were trending slightly higher at 32,812 units in May compared to 32,680 in April according to Canada Mortgage and Housing Corporation (CMHC). The trend is a six month moving average of the monthly seasonally adjusted annual rates (SAAR)1 of housing starts.

“Sales of single-detached homes began to strengthen in 2013 and some appear to have translated into starts by May 2014. However, fewer overall new home sales last year continued to drag down total starts activity this year,” said Ed Heese, CMHC’s Toronto Senior Market Analyst.

CMHC uses the trend measure as a complement to the monthly SAAR of housing starts to account for considerable swings in monthly estimates and obtain a more complete picture of the state of the housing market. In some situations, analysing only SAAR data can be misleading in some markets, as they are largely driven by the multiples segment of the markets which can be quite variable from one month to the next.

The stand alone monthly SAAR was 37,594 units in May, up from 36,076 in April.

Preliminary Housing Starts data is also available in English and French at the following link: Preliminary Housing Starts Tables

As Canada’s national housing agency, CMHC draws on more than 65 years of experience to help Canadians access a variety of quality, environmentally sustainable and affordable housing solutions. CMHC also provides reliable, impartial and up-to-date housing market reports, analysis and knowledge to support and assist consumers and the housing industry in making informed decisions.

Follow CMHC on Twitter @CMHC_ca

1 All starts figures in this release, other than actual starts and the trend estimate, are seasonally adjusted annual rates (SAAR) — that is, monthly figures adjusted to remove normal seasonal variation and multiplied by 12 to reflect annual levels. By removing seasonal ups and downs, seasonal adjustment allows for a comparison from one season to the next and from one month to the next. Reporting monthly figures at annual rates indicates the annual level of starts that would be obtained if the monthly pace was maintained for 12 months. This facilitates comparison of the current pace of activity to annual forecasts as well as to historical annual levels.

Information on this release:

Market Analysis Contact:

Ed Heese

416-218-3369

eheese@cmhc.ca

Media Contact:

Beth Bailey

416-218-3355

bbailey@cmhc.ca

Additional data is available upon request.

Source: CMHC

1 Census Metropolitan Area

2 The trend is a six-month moving average of the monthly seasonally adjusted annual rates (SAAR).

Detailed data available upon request

Article source: http://www.cmhc.ca/en/corp/nero/nere/2014/2014-06-09-0816b.cfm